Is a 0% Churn Actually Possible?

In customer success, we spend a lot of time worrying about the churn rate. Well, everyone in a SaaS businesses worries about churn, but it’s a direct concern for customer success managers (and sales if those two teams are aligned properly).

Understanding your churn rate is a useful way to get a snapshot of your businesses performance. If the churn rate is lower than the last time you measured, you’re doing something right. If churn is higher, you need to identify the problem and fix it. Furthermore, your churn rate is needed to track other metrics, like projected revenue and customer lifetime value.

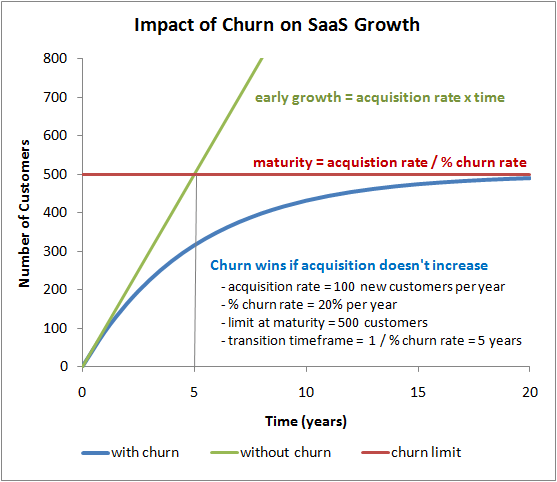

The impact of churn is clear, as explained in this image by Chaotic Flow. Even if acquisitions is greater than churn, it can still severely handicap your growth.

Successful businesses use multiple churn rates to get a clear picture of their performance. It’s smart to track the churn rate for different customer segments or verticals, because those groups might require unique solutions that don’t apply to your customers as a whole.

The different types of churn

First, understand the different types of churn rates. Customer acquisition is important, but many SaaS businesses spend too much time on it and neglect customer retention.

Each of these rates can be calculated for different customer segments. For instance, you might have three customer groups: small businesses, medium businesses, and large businesses. You should calculate each rate for each group. This will give you a handle on how they are performing individually so you can design strategies that address the problems of each group.

1. Basic Customer Churn

Your basic churn is the rate customers cancel, close, or fail to renew a recurring billing subscription. It’s also known as an attrition rate.

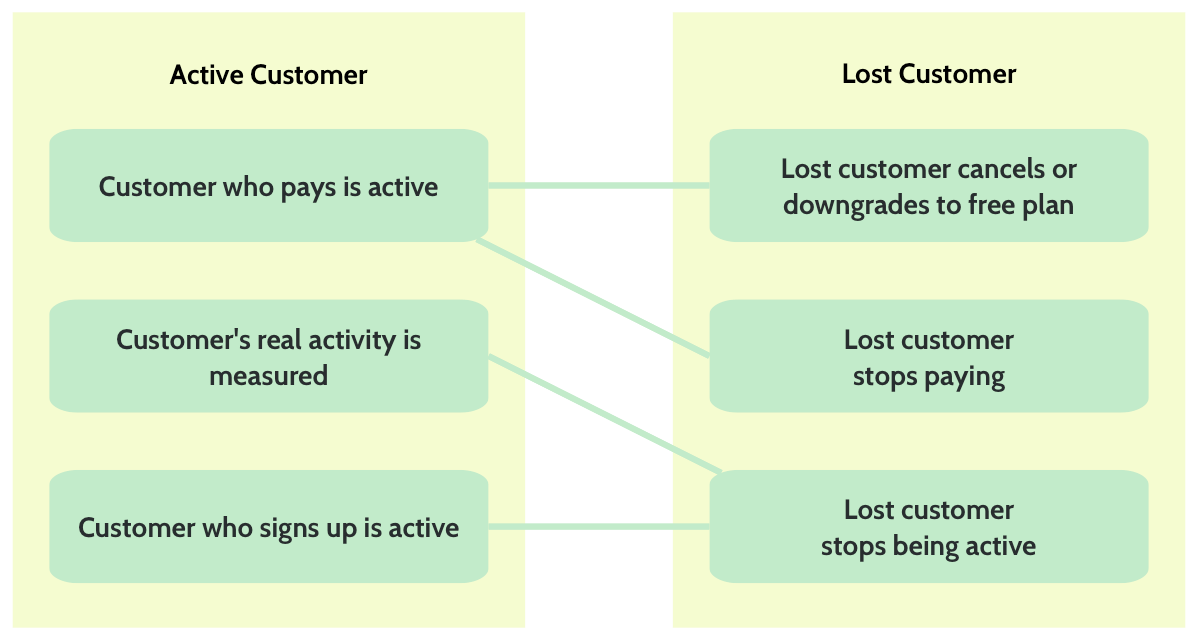

The actions that you specifically define as churn will depend on your product and your customer. Jaana Kulmala, founder of FirstOfficer.io, argues churn is when a customer cancels services, downgrades their plan, or stops being active on your platform.

At one time, there were a number of ways to calculate churn. That ambiguity got Netflix in some legal trouble. They were accused of misrepresenting their churn rate to their investors.

After that, SaaS businesses informally adopted a definition of churn: the percentage of participants who discontinue their use of a service divided by the average number of total participants during a given period of time. If you use a different formula, make sure your stakeholders are aware so they don’t feel misled.

Keep in mind that this number is inherently misleading because it assumes churn is spread evenly over the measured time period. If you only calculate churn on a yearly basis, you wouldn’t notice if a majority of it happened in September. I recommend calculating churn at least quarterly so you can identify reasons why people churned (and figure out what the heck happened in September).

2. Discretionary Churn

The basic churn formula doesn’t calculate customers who are locked into contracts for custom term periods. You may sell to most of your customers on a month-to-month basis, but some bigger deals will come with customized agreements. If a customer can’t churn this month, should they be counted towards your churn rate?

No, because that would make your churn look lower than it really is. Discretionary churn is the percentage of customers who don’t renew out of the pool of eligible-to-churn customers. If a particular customer doesn’t have the option to churn, they wouldn’t be counted.

3. MRR Churn

Both of the above churn rates determine the number of customers that churn. But that isn’t enough data for a proper high-level view of the company because it doesn’t give an insight into revenue.

In most companies, different customers pay different rates. You have different pricing tiers and make different deals. If you have a hundred customers and only lost three, you would think “3% churn rate isn’t so bad.” But if those three customers represented 50% of your revenue, you are in bad shape.

MRR churn (monthly recurring revenue, or sometimes called DRR: dollar revenue retention) calculates churn in terms of revenue lost. You would divide the revenue generated from churned customers by the total revenue of customers who could churn within a given time period.

Founders, board members, venture capitalists, and anyone with a stake in the company typically prefer to see churn expressed in dollars because it paints a clearer picture of the company’s health. After all, the business’ goal is to generate revenue.

4. Negative Churn

This is a strange concept, but it’s a powerful way to grow your business. Negative churn is technically just a negative state of your MRR churn, but it’s worth mentioning separately. It is achieved when expansions/upgrades/upsells/cross-sells exceed the revenue lost from basic churn.

The only way negative churn works is if your pricing allows for expansions or cross-sells. You should price your application so that additional services can be included for bigger invoices, even if you don’t advertise them. It also works if you charge by some usage metric (e.g. Email marketing tool MailChimp, which charges by the number of subscribers).

Truthfully, negative MRR churn is the real goal because it means more money flows in every month than you lose.

So is 0% churn possible?

As you can see, this is a poor question because there are different types of churn. Is it possible to reduce basic or discretionary churn to 0%? Yes, but it’s unlikely.

Through no fault of your own, some of your customers are going to cancel their service at some point. Even multi-million dollar enterprise SaaS businesses lose clients over things they can’t control. Expecting to hold on to every client forever isn’t realistic.

Low-touch SaaS products have it even tougher. When you aren’t on the phone with your customer every week, it’s very easy for them to hit that “unsubscribe” button. They don’t have much stake in your application and don’t have to explain to anyone in a meeting why they’ve decided to go with a competitor or change their internal process.

Can your MMR churn drop to 0%? Yes, but that isn’t sustainable (just like holding to any specific number isn’t sustainable). 0% MRR would mean your revenue is staying flat, even though you are naturally gaining and losing customers.

Ideally, you want to put yourself in a position of negative MRR churn across all customer segments and verticals. Negative churn will grow your business rapidly.

Look at it this way: You have 5 customers, all paying $500/month. At the end of six months, you have $15,000. If you managed to upsell three of those customers to $750/month, you would have $19,500 in six months, a 30% increase in revenue.

So don’t focus on 0% MRR churn. Focus on less than 0%.

That said, basic and discretionary churn are still useful metrics. Lincoln Murphy explains why perfectly: “If you’re losing customers (even if you’re growing revenue with the remaining customers), something is wrong.” High basic and discretionary churn rates could mean you are misspending on customer acquisition, attracting the wrong customers, burning resources on low-value customers, or failing to create engagement with your application.

The secret of churn

Customers churn for one of two reasons: 1) Your product doesn’t have enough value for them, or 2) You didn’t communicate your product’s value well enough.

There are a thousand ways to reduce your churn rate, but in the end, it all boils down to making your product valuable for the customer and making them aware of that value. That means investing heavily in product development and customer success.

If you need some help improving your churn rate, contact us.